Year to Date (YTD): Definition, Formula & Example

There are many different ways for business trends to be analyzed before the financial year is over. In a lot of situations, it may be necessary to call for the use of a year-to-date, or YTD, comparison.

Read on as we take a look at exactly what this is, how it’s used, and the formula used to calculate it.

Table of Contents

KEY TAKEAWAYS

- A period of time starting on the first day of the current calendar year or fiscal year and ending on the present date is referred to as the YTD.

- Some governmental institutions and businesses have fiscal years that start on a day different from January 1.

- Managers can examine interim financial statements in contrast to prior YTD financial statements by using a YTD analysis.

What Is Year to Date (YTD)?

Year to date (YTD) refers to the duration starting on the first day of the current fiscal or calendar year and ending on the current day. YTD data can be used to compare performance to peers or competitors in the same industry or to analyze business trends over time. The abbreviation is frequently used to modify ideas like investment returns, earnings, and net pay.

How Year to Date (YTD) Is Used

When the term YTD is used in relation to a calendar year, it refers to the exact time between January 1 of the current year and the present date. When a fiscal year is mentioned using the term YTD, it refers to the time from the start of that particular fiscal year till the present.

A fiscal year is a span of time that lasts for one year but does not always start on January 1. Governments, businesses, and other organizations use it for external auditing and accounting purposes.

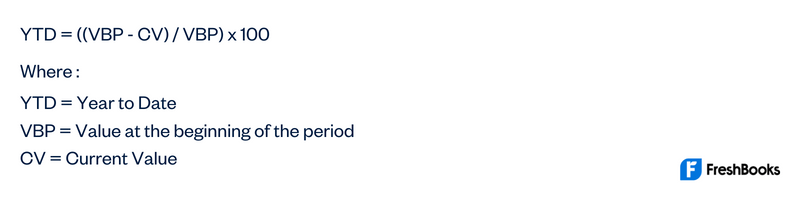

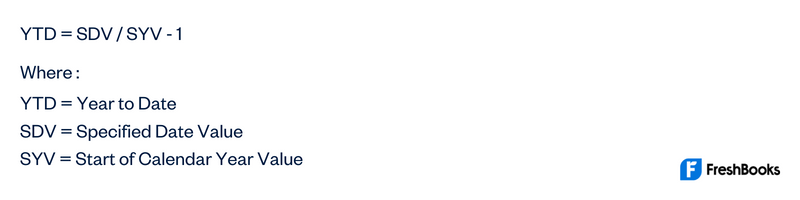

Year to Date Calculation Formula

The year to date formula can be shown in two ways. They are as follows:

or

Year to Date Types

Year to Date Returns

The amount of profit an investment has generated since the start of the current year is referred to as the YTD return. YTD return data is used by analysts and investors to evaluate the performance of portfolios and investments.

Subtract the investment’s value from its current value to determine the YTD return on investment. Next, multiply the result by 100 to convert it to a percentage by dividing the difference by the value on the first day.

Year to Date Earnings

Earnings as of the present date are referred to as YTD earnings or year-to-date earnings. Along with details on Medicare and Social Security withholdings and income tax payments, this sum is often listed on an employee’s pay stub.

YTD earnings can also be used to indicate how much a company or independent contractor has made so far this year. This sum is made up of income less outgoing costs. Small-business owners manage their financial objectives and forecast their quarterly tax payments using YTD earnings.

Year to Date Net Pay

The difference between employee wages and the deductions made from those wages is known as net pay. Employees deduct tax and other withholdings from their gross salary to determine their net pay.

The term “YTD net pay” can be found on many pay stubs, and it refers to the total income generated as of January 1 of the current year minus all tax and other benefit deductions.

What Does Year to Date Determine?

Financial statements from the current period and those from the prior period for the same period are frequently compared. For example, if a company’s fiscal year started on July 1, its three-month YTD financial statement would cover the period from July 1 to September 30.

To check for seasonal tendencies or anomalies, the September YTD financial statement for the current year can be compared to the September YTD financial statement from the preceding year or years.

Example of Year to Date

Let’s say that an investor is considering a portfolio that consists of three separate stocks. The investment in this portfolio is sitting at $100,000. This alludes to the value at the start of the calendar year.

At the end of the eleventh month, the portfolio now consists of equities with a value of $150,000 because the stock market has outperformed during the previous time period of eleven months.

At this current time, the gain or YTD return is $50,000, and the gain divided by the value at the start of the period will yield the YTD return %. This results in a 50% YTD return on investment percentage and shows a 50% YTD increase in the portfolio.

Summary

Year to date (YTD) is one metric used to assess a business’s financial development. The business can examine performance trends throughout the year rather than wait for year-end results. This is a quick and easy technique to gauge development over time.

Although it’s important to note that YTD shouldn’t be used in isolation. When considering a portfolio or investment, you should always use a wide range of metrics to gain the best view.

FAQS on Year to Date

The amount of profit (or loss) an investment has experienced from the first trading day of the current calendar year is known as the YTD return.

According to market conditions, many financial planners estimate that the typical 401(k) portfolio yields an average annual return of 5% to 8%.

The amount spent on payroll from the start of the year (calendar or fiscal) to the current payroll date is known as year-to-date payroll. YTD is computed using the gross salaries of your employees. Before taxes and other deductions, an employee’s gross income is what they are paid.

Share: